Single Family Office in Singapore

There are about 200 Single Family Offices (SFOs) in Singapore and the number has grown in recent years, Tharman Shanmugaratnam, Senior Minister and minister in charge of the Monetary Authority of Singapore (MAS), told the Singapore parliament on 5 October.

He said the MAS did not have hard data on the scale of their operations because SFOs do not manage third party monies and are therefore not registered with or licensed by MAS. However, industry research estimates that each SFO typically manages assets in excess of US$100 million, so total assets under management by SFOs could be around US$20 billion.

The term ‘single family office’ is not defined in the Securities and Futures Act, but MAS states that the term generally refers to an entity that manages assets for or on behalf of a family, and which is also wholly owned or controlled by the members of that same family.

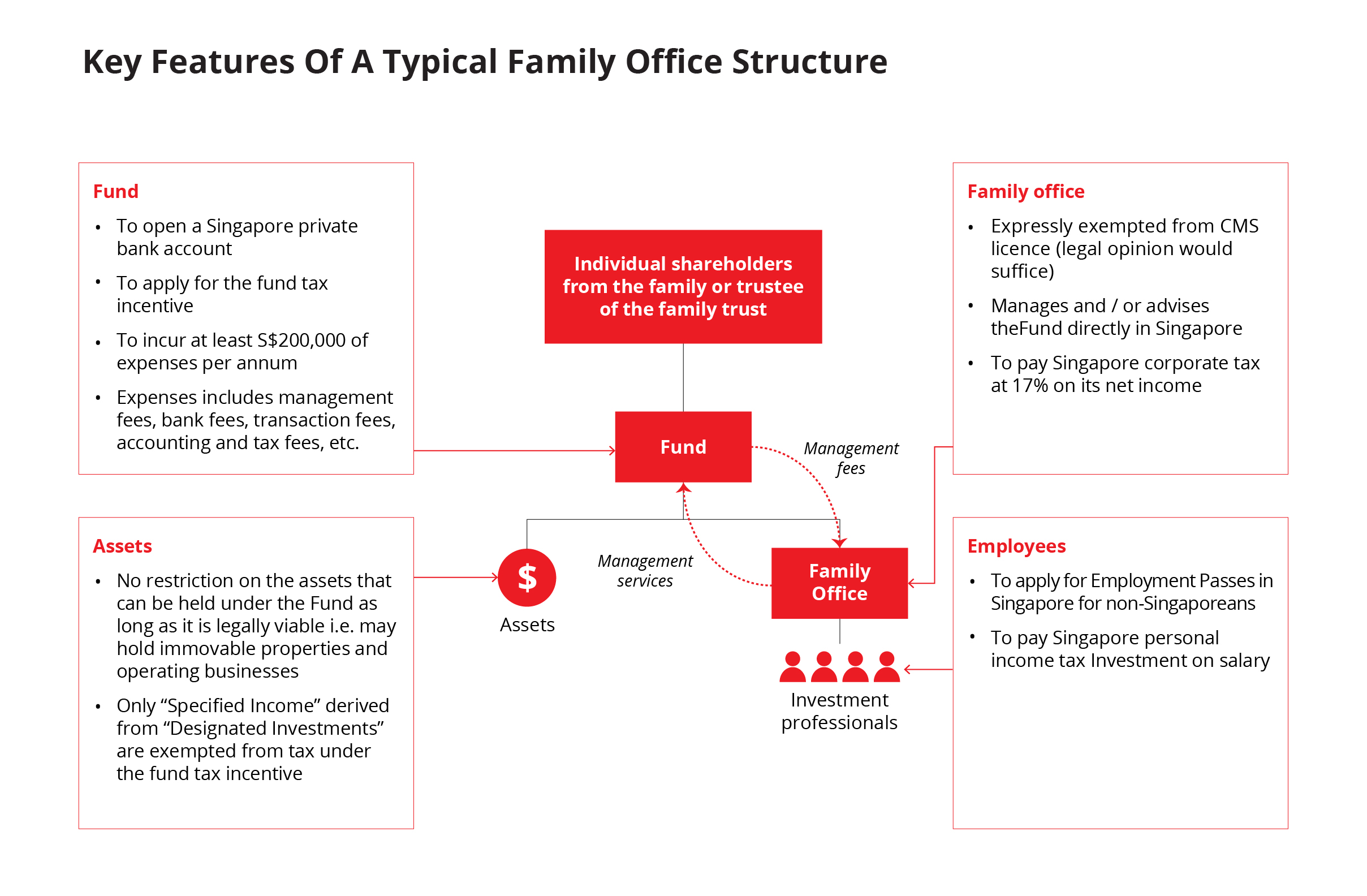

An SFO typically conducts various activities to facilitate the day-to-day management of a family’s assets. The activities involved are diverse and would include investment management, consolidation of the family’s accounts and tax filing. A simplified depiction of a typical ownership structure of a family office may be seen in the diagram below:

SFOs usually employ small teams of trusted advisers and investment professionals, and also generate indirect employment in Singapore through their engagement of external finance, tax and legal professionals for advice on wealth planning and operational matters.

Why Singapore

Singapore is regarded as one of the most prominent financial centres in South-East Asia and has gained in popularity as a base for many high-net-worth families to manage their assets and investments globally. Singapore enjoys a reputation as a well-governed and well-regulated financial centre that offers political stability and a pro-business environment, as well as the presence of local and global private banks, investment banks and other financial service providers and professionals.

Singapore has a highly competitive tax system. The corporate tax rate of 17% is imposed on income that is either Singapore sourced or is remitted into Singapore. Singapore does not tax capital gains and the basis of taxation is further reduced by a number of exemptions. For corporate resident taxpayers, foreign dividends that have been subject to some foreign tax and are paid from a jurisdiction with a headline rate of at least 15% are exempt. Dividends paid by a Singapore resident company are exempt from further taxation.

Singapore also has a large network of double taxation agreements that can reduce taxation at source on certain types of income and gains.

The Singapore government has put in place a number of tax incentive schemes for funds managed by family offices for both offshore and onshore vehicles. These require a Singapore manager that is either licensed or exempt under local securities law for providing fund management services. An SFO is typically structured as a ‘related corporation’ of the family fund vehicle so that it is exempt from regulation. An exemption from licensing can also be granted to a single-family office that can demonstrate that it only manages the assets of the same family.

Specific tax exemption incentives for funds managed by family offices are available for both Singapore resident and non-resident (offshore) fund vehicles, such that almost all investment gains will be exempt from Singapore income tax. These include:

13R and 13X Schemes

Successful applicants under the 13R and 13X schemes will be granted employment passes (one for 13R and three for 13X), which can offer an interim solution pending permanent residency applications.

13R and 13X funds that are approved for the tax incentive scheme before 31 December 2024 can enjoy the benefits of the scheme for the life of the fund, provided that the on-going operational conditions for the entities are met.

Family offices set up under the 13R and 13X scheme can also utilise the new Variable Capital Company (VCC) structure, which came into force on 14 January 2020. A VCC can be set up as a standalone fund, or as an umbrella fund with two or more sub-funds. A VCC structure is regarded as a single company, with a single identity for tax purposes, removing the need for multiple tax returns.

Shares of a VCC are redeemable at the fund’s net asset value (NAV), and VCCs can pay dividends from the capital, which is not typically allowable in other forms of corporate vehicles. In addition, VCC shareholders register will not be publicly available, offering privacy to investors.

Alongside the 13R and 13X schemes, the Economic Development Board (EDB) of Singapore has also introduced the Global Investor Programme (GIP) for families intending to relocate to Singapore. The GIP awards Singapore Permanent Resident (PR) status to eligible global investors and includes an option that is specifically designed for family offices.

Eligible investors must invest at least S$2.5 million (paid up capital) in a Singapore-based SFO that has AUM of more than S$200 million and maintain the investment for at least five years.

To qualify under this option, investors must have at least five years of entrepreneurial, investment or management track record and, as an individual or direct family, have net worth of more than S$400 million. Investors must also submit a five-year business plan outlining projected employment and annual financial expenditures, which should set out the functions of the family office, proposed investment sectors, asset types and geographical focus.

Aside from the tax exemption schemes available to the fund vehicles, family offices in Singapore could also apply for a tax incentive under the Financial Sector Incentive – Fund Management Scheme (FSI-FM) which incentivises fund management and the provision of investment advisory services in Singapore. Under this scheme, fee income derived by a Singapore fund manager from managing or advising a qualifying fund is taxed at a concessionary tax rate of 10% instead of the normal corporate tax rate of 17%.

To qualify for the FSI-FM scheme, a fund manager must hold a Capital Markets Services (CMS) licence (unless exempted by the MAS), employ at least three experienced investment professionals earning at least S$3,500 per month and have a minimum AUM of S$250 million. This is especially relevant for large family offices, where the scale of operations and the income derived from managing or advising qualifying funds could be substantial.

Requirements

Explore Private Client Services in Singapore

Please contact us if you have any questions or queries and your local representative will be in touch with you as soon as possible.