Portugal’s Golden Visa – a favourite ‘Plan B’ residence option for international investors

A full member state of the European Union since 1986, Portugal has emerged as the primary destination for individuals, families and businesses seeking residence and a trading presence in the EU. Portugal’s key attractions are a stable political and social environment, clear and transparent tax rules, good infrastructure, a favourable investment climate, a skilled labour force and an excellent quality of life.

The Sovereign Group opened its office in Portugal in 1999, specifically to meet the increasing demand from foreign residents and foreign property owners for ‘fiscal representation’ and accounting services in Portugal. Following the introduction of a range of residence-by-investment (RBI) programmes, our Portugal-based team has also been assisting investors, retirees, and their families to establish and maintain residency under Portugal’s ‘Golden Visa’, Corporate Establishment and Passive Income (D7) programmes.

Golden Visa Residence Permit

First introduced in 2012, the Portuguese ‘Autorização de Residência para Investimento’ (ARI) – more commonly referred to as the Portugal Golden Visa Residence Permit – provides qualifying individuals and their family with full rights to live, work and study in Portugal.

The Golden Visa also provides visa free travel access throughout the Schengen zone and, after five years of residence in Portugal, the right to apply for permanent residency or citizenship.

The programme is particularly attractive to those who do not intend to move to Portugal immediately but wish to put in place an alternative option, or ‘plan B’, in case they, or any of their family members, might wish (or need) to relocate in the future. This is because the Golden Visa has only a token ‘minimum stay requirement’ to maintain the visa – an average of only seven days per year.

Golden Visa Benefits

Benefits of the Golden Visa programme include, but are not limited to:

- Multiple investment options.

- An applicant may include dependent children and parents.

- Visa-free travel within the Schengen Zone for 90 days within any 180 days.

- Low minimum stay requirement, averaging just seven days per year.

- A route to qualification for citizenship or permanent residency after five years.

- No tax on global income if the holder is resident in Portugal for less than 183 days per year.

Golden Visa Qualifying Investment Options

- Invest €500,000 in a qualifying investment fund(s).

- Establish a single-shareholder private limited company that creates at least 10 sustainable jobs that are based in Portugal.

- Invest €500,000 in scientific research in Portugal that will benefit the national scientific and technological infrastructure.

- Donate €250,000 in support of an artistic production, or the maintenance or recovery of cultural heritage.

- Invest €500,000 into a new or existing company that causes the creation of 5 or 10 jobs respectively for a minimum period of three years.

The minimum investment amounts for options 3, 4, and 5 can be reduced by 20% if the investment activity is carried out in a low-density area (defined as areas with fewer than 100 inhabitants per square kilometre or GDP per capita of under 75% of the national average).

Golden Visa Qualifying Investment Funds

Since the removal of all real estate-related qualifying investments in October 2023, the most popular passive investment option is to make an investment of €500,000 in qualifying investment or venture capital funds.

To qualify, investment funds must be registered and regulated by the Portuguese Securities Market Commission (CMVM), have at least 60% of capital invested in Portugal, and may not, either directly or indirectly, be invested in real estate.

The benefits of choosing to invest in a qualifying investment fund include:

- Qualifying minimum investment requirement of €500,000.

- Fully managed solutions are available.

- Regulated by the Portuguese Securities Market Commission (CMVM)

- A wide range of assets classes to choose from.

- 0% tax applicable to the purchase or sale of units.

- 0% income tax on investment income for non-tax residents and only 10% for tax residents.

Applicants can choose to diversify their investment across any number of qualifying funds to gain access to different asset classes, sectors and fund managers and thereby to reduce the overall risk in their investment portfolio.

The Sovereign Group does not provide investment advice, but we have conducted preliminary due diligence on a panel of qualifying investment fund managers that we are comfortable to introduce to interested parties. The enables applicants to examine and discuss the investment strategy, terms and conditions across a range of funds before determining which overall investment strategy is most suitable to their personal needs.

Additional Qualification Requirements

All Golden Visa applicants must also provide evidence of the following:

- Medical insurance

- Valid Passport & Schengen Visa

- Confirmation that they have made a qualifying investment.

- A Portuguese bank account and tax ID

- Evidence that they have submitted their application and biometrics to the AIMA.

- No previous criminal convictions of a crime punishable in Portugal by more than 1-year imprisonment

EU, EEA and Swiss citizens do not qualify for the Portuguese Golden Visa Residence Permit. Sovereign does however provide alternate residency solutions for EU, EEA & Swiss citizens who would like to establish residency in Portugal.

Application Process

With a long-established office, team and professional service partners in Portugal, Sovereign is very well placed to assist, advise and support applicants throughout the application process. We work closely with applicants during each stage to ensure that they will qualify for and ultimately receive the Golden Visa Residence Permit.

The application process involves the following:

Stage 1 – Hold an initial consultation with a Sovereign residency and citizenship adviser to determine the most suitable programme and investment options available.

Stage 2 – Sovereign will prepare and provide a comprehensive proposal detailing the benefits, requirements and investment options applicable. Our team will introduce applicants to qualifying investment providers.

Stage 3 – Working with a Power of Attorney, Sovereign will assist with opening a local bank account and obtaining a Portuguese tax identification number.

Stage 4 – Sovereign will work with applicants to prepare and submit their Golden Visa application. Once submitted and approved online, all applicants are required to personally attend an appointment with the Agency for Integration, Migration, and Asylum (AIMA) to submit the original documentation and their biometric data.

Stage 5 – If all application requirements have been met, the related documentation is in order and the biometrics data has been verified, the application will be approved.

Stage 6 – Once approved, individual residency permit cards will be issued.

Minimum Stay and Permit Renewal Requirements

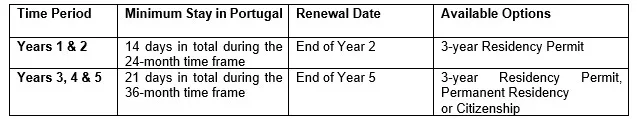

Once an application has been approved, applicants are issued a Portuguese residency card, which is valid for two years. To maintain residency, the card must be renewed at the end of the second year, at which time a three-year residency card will be issued. The following chart provides an overview of the ongoing minimum stay and permit renewal requirements.

To ensure the successful renewal of residency cards, all initial investments and application requirements must continue to be met.

Documentation required for application

From the applicant’s country of origin:

- Valid passport and Schengen visa.

- Criminal Record Certificate.

- Proof of residence.

- Proof of professional occupation.

- Marriage certificate, if including a spouse.

- Birth certificates of any children to be included.

- Birth certificates of the applicant, if including dependent parents

- Certificates of no income for parents under the age of 65.

All foreign-language documents must be translated into Portuguese and certified by a Portuguese consulate-accredited translator or a Portuguese lawyer.

From within Portugal:

- Completed application and permission to search for Portuguese criminal record.

- A Portuguese tax identification number.

- Certificate of no debts from the Portuguese tax and national insurance offices.

- Signed statement by the applicant confirming that they have fulfilled qualifying investment requirements.

- Evidence that the minimum investment has been made.

- Receipt of payment of the application fee.

Sovereign representatives will be on hand to assist applicants and their families to secure and complete the documents required to successfully submit and process their application.

Portuguese Citizenship or Permanent Residency

Once an individual and/or family member has maintained legal residency in Portugal for five years or more (calculated from the submission date of their initial residency application), they are eligible to apply for Permanent Residency in Portugal or Portuguese citizenship.

Please note applicants must also meet a Portuguese language requirement (Level A2), provide evidence that they have developed ‘plausible links and connections’ to Portugal and have not been convicted of a crime that is punishable in Portugal by a prison sentence of three years or more.

Upon approval of either option, investors can sell and recuperate their initial Golden visa qualifying investment.

Comprehensive Residency, Tax residency and Citizenship planning

Sovereign’s global office network, experienced local teams and professional service partners ensure that we are well placed to assist clients in the development and implementation of the most suitable overall residence, tax residence and/or citizenship strategy for their needs.

Sovereign works closely with applicants during each stage of the planning and implementation process. When combined and managed correctly, the following Sovereign Group services will also enable clients to develop and implement a comprehensive, flexible and tax efficient strategy:

- International residency and citizenship programmes.

- Corporate structures and banking.

- Tax residency programmes and planning.

- Trusts and foundation structures.

- Estate and succession planning.

- International retirement plans.

- Wealth management.

- International life and medical insurances.

For further information, to discuss your requirements and/or to determine whether you qualify for any of our residency or citizenship programmes, please contact Sovereign’s Residency and Citizenship Planning team below.