The Residency and Citizenship (R&C) industry is continuously evolving with the creation of new government programmes, the addition or removal of options and benefits within existing programmes, or the abolition of programmes that are no longer considered beneficial to the economy or society.

This, combined with the fact that no two clients have identical requirements and objectives, means that R&C planning should be approached holistically; not from the standpoint that one or two solutions will fit all. Sovereign monitors the market to ensure that our information is comprehensive and up to date and that we can provide access to a broad range of R&C and tax residency options.

The Sovereign Group’s global network of offices, experienced local teams and professional service partners ensure that we are well placed to assist clients with the identification, development and implementation of the most suitable overall strategy for their needs.

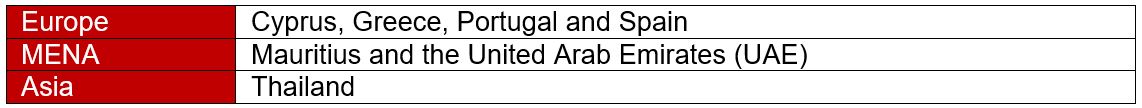

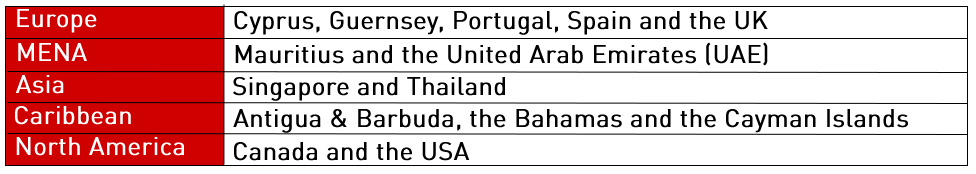

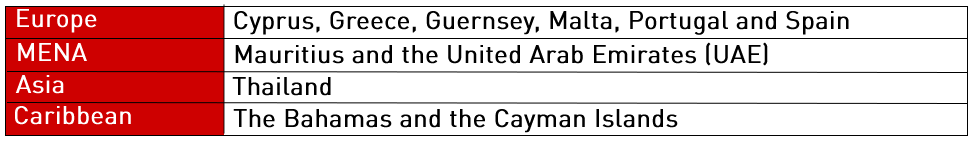

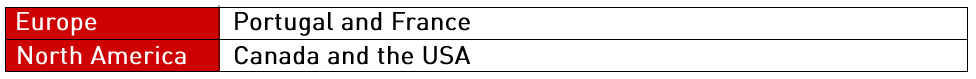

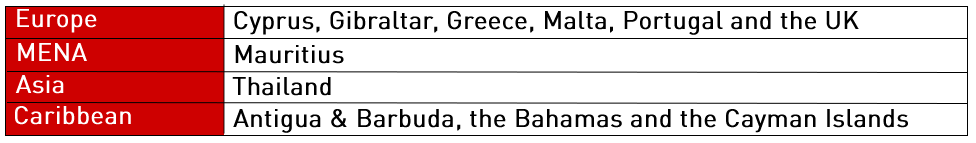

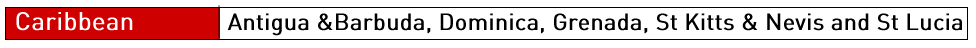

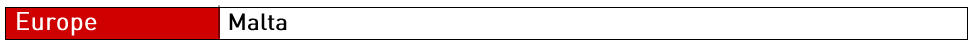

Our current range of international programmes is set out below. These options can be implemented independently, or they can be combined where a more complex solution is required to meet the needs of a client and their family or business.

- Financially Independent/Self-Support or Passive Income Programmes

To offer residence permits to applicants who can demonstrate a passive income or personal wealth above a specified amount. These generally require the holder to make the chosen country their primary place of residence and place of tax residence.

- Active, Start-up and Business Investment Programmes

To offer residence permits to applicants who establish and/or invest in a business, creating local employment opportunities and economic activity in the chosen country.

- Residency by Investment (RBI) Programmes

Often referred to as ‘Golden Visas’, RBI programmes provide individuals and their dependents with a residence permit and a wide range of associated benefits in exchange for a passive investment. In most cases, these programmes have low minimum stay requirements.

- Business Incubation Programmes

To provide residence permits to applicants who Invest and work with specialist business incubation partners and local government-backed research and development (R&D) facilitators to establish a local business and economic activity.

- Tax Residency

Countries offering official tax residency programmes or preferential rates for non-domiciled individuals who establish tax residency.

Citizenship Programmes

- Direct Citizenship

Programmes that offer citizenship within three to six months in exchange for an investment or government donation, generally with no physical presence requirements.

- Indirect Citizenship

Programmes offering citizenship in exchange for government donations following a one or three-year period of legal residency.

- Citizenship through Naturalisation

The legal process by which a non-citizen of a country may qualify for citizenship after a certain period of time holding legal residency status. The rules of naturalisation vary from country to country. Typically, they include a promise to obey and uphold that country’s laws and may include additional requirements such as demonstrating an adequate knowledge of a country’s language and culture.

Solid foundation for wealth management

Correctly planned and implemented, R&C programmes provide a solid foundation that enable individuals and families to build comprehensive, flexible and tax efficient wealth management strategies. Sovereign works closely with applicants at every stage of the process and can provide the following services:

- International R&C programmes

- Tax residency

- Trusts and foundations

- Estate and succession planning

- International retirement plans

- Wealth management

- Corporate structures and banking

- International life and medical insurances.

Contact us

Each programme listed provides a range of different benefits to applicants who can fulfill the qualifying and documentary requirements set out in the application procedures. By delivering a holistic approach to R&C planning, Sovereign can ensure that our clients receive objective and impartial advice as to the programme(s) worldwide that will best suit their circumstances and goals. We can also ensure that the application process is as straightforward as possible.

To learn more about our range of programmes or to discuss how you, your family or business might benefit from the creation and implementation of an international R&C or tax residency strategy, please contact Ceri Pratley.