‘Auto enrolment’ pensions finally underway in Gibraltar

Gibraltar’s new ‘auto-enrolment’ pensions regime, which was introduced to ensure that every member of the community, including those working in the private sector, is financially protected in their later years, was brought into operation on 1 July for the largest employers in Gibraltar.

Like the ‘auto enrolment’ pensions regime in the UK, the Private Sector Pensions Act makes it mandatory for all employers in Gibraltar to provide access for all eligible employees to a pension scheme in addition to the existing State Pension. Should an employee choose to join the pension scheme, the Act also makes it compulsory for both the employer and employee to contribute a minimum amount each week or month (depending on how the employee is paid) to the employee’s pension fund.

Gibraltar employees eligible for ‘auto enrolment’ must be over the age of 15, have worked for an employer for one year or more and have gross earnings from that employment of £10,000 or more per year.

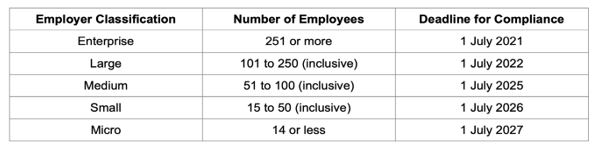

The Gibraltar government decided to phase in implementation of the regime to give smaller employers more time to adjust to the new requirements. The first applicable date was 1 July 2021, when ‘Enterprise’ employers (those with over 250 employees) were required to provide a pension plan to any employee who requests it. The process will conclude on 1 July 2027, when ‘Micro’ employers (those with 14 or fewer employees) will be brought into scope.

Just before the Act was brought into operation, the government introduced a number of changes to the legislation via the Private Sector Pensions (Amendment) Act. As well as removing the previous turnover and balance sheet size criteria for employer classification, leaving number of employees as the only measure, it made the following changes:

- Appointed the Gibraltar Financial Services Commission (GFSC) as the Pension Commissioner.

- Empowered the Pension Commissioner to charge fees.

- Established a ‘Register of Employers Maintaining Pension Plans’.

- Provided for a complaint’s procedure overseen by the Financial Services Ombudsman.

The GFSC will be responsible for establishing and maintaining the Register and administrators of occupational pension plans are required to advise the GFSC before 30 September 2021 of the status of all employees according to the following categories:

- Pension scheme members.

- Ineligible employees.

- Employees who have opted out.

After 30 September 2021, administrators will also have to advise the GFSC of any ‘auto-enrolment’ pension scheme joiners and leavers. Those employees who opt not to join a company’s pension plan will be required to sign an annual waiver stating that they do not require a pension.

The new Act appoints the Financial Services Ombudsman to deal with any complaints and he/she is empowered to “investigate, facilitate, mediate, propose or determine solutions to a dispute arising from the provisions of this Act and submitted by or on behalf of an employee or other beneficiary of a pension provided pursuant to this Act.”

Careful planning will be required when dealing with Spanish-resident employees because personal pensions and Gibraltar government pension schemes are not recognised in Spain and could lead to additional tax bills.

Corporate pensions or savings provision are a vital consideration for any employer that wishes to attract and retain the best talent, as well as maintain a loyal and committed workforce. Since the introduction of ‘auto-enrolment’ in the UK in 2012, annual pension saving in the UK has increased by more than £7 billion and more than 10 million more people are now saving into a pension scheme.

Most employees now regard retirement provision as a key part of their remuneration package, so ‘auto enrolment’ is effectively making mandatory what was previously just good practice. Private sector employers should take responsibility for their employees and those businesses that plan effectively now should ultimately win out in the longer term.