When you’re setting up a business in Dubai, one of the first things you need to get right is the legal structure. It shapes everything—your risk, your taxes, your options down the line.

Two structures come up more than any others: the Limited Liability Company (LLC) and the Sole Establishment. Both are well-established, widely used and backed by clear procedures. But they’re built for different types of businesses.

An LLC offers protection for personal assets and is often a better fit for companies planning to hire, scale or bring in partners. A Sole Establishment, on the other hand, is simpler and suits professionals who want to work independently under their own name.

Let’s look at how the two compare—so you can decide which one suits your plans.

What Is a Sole Establishment in Dubai?

A sole establishment is a business owned by one person who takes full responsibility for its profits, losses and liabilities. It’s a common choice for consultants, freelancers and other professionals offering specialised services under their own name.

Setup is straightforward. The paperwork is light, the fees are relatively low and the owner has complete control over the business. There are no partners to consult, no shareholders to involve and no company board to manage. That simplicity makes it appealing to professionals who want to get started quickly and stay in charge.

Foreigners can still own 100% of a sole establishment in many cases, especially in the professional services sector. Depending on the activity and the licensing authority, some owners may need to appoint a local service agent—a UAE national who acts as a formal liaison with government departments. This requirement is not universal and has been relaxed in recent years, particularly in Dubai.

This setup works well when the model is clear and the risk is low. That said, the owner is personally liable for any debts or legal claims, which is something to weigh up before choosing this route.

Pros

- Easy to set up

- Full control

- Lower setup costs

- Eligible for small business tax relief (subject to conditions)

Cons

- Unlimited personal liability

- Harder to raise capital

- Less appealing to banks and investors

What Is an LLC in Dubai?

The LLC is the most common business structure in Dubai since it offers a good blend of flexibility and protection. It’s a separate legal entity, which means the company takes on the risk—not the individual owners. If something goes wrong, the shareholders are only liable up to the amount they’ve invested.

You can set up an LLC in either a free zone or on the mainland. Free zones often appeal to businesses focused on international trade or digital services. They offer full foreign ownership and simplified setup, but they come with trade restrictions outside the zone. Mainland LLCs, on the other hand, give you access to the UAE market without limitation and can work with government clients. Most sectors now allow 100% foreign ownership, though some still require a local partner or agent.

An LLC also comes with a few built-in advantages. It tends to carry more weight with banks, landlords and investors. It makes it easier to hire staff, apply for visas, and grow beyond a one-person setup. It can also hold assets, open a bank account in the company name and apply for multiple business activities under one licence.

Pros

- Personal asset protection

- Room to grow

- Access to local and international markets

- Easier to attract partners or investors

Cons

- Higher setup and renewal costs

- More steps and formalities

Key differences: LLC vs Sole Establishment

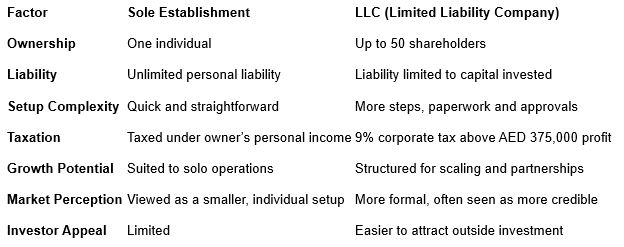

The structure you choose shapes how your business operates day to day—how it’s owned, how much protection it offers, how investors and banks see it, and how easy it is to grow. Here’s a side-by-side look at the key differences between the two structures:

The choice between the two will depend on your goals, appetite for risk and how you see your business evolving over time.

Changing from Sole Establishment to LLC

Plenty of businesses in the UAE start out as sole establishments and later switch to an LLC. The reasons are generally to limit personal risk, bring in partners, or get access to bigger contracts and financing.

While it’s a well-trodden path, the process isn’t just a licence swap. Legally, you’re setting up a new entity and transferring the business over. That means updating the commercial register, notifying creditors, and publishing notices in Arabic newspapers. If those steps aren’t followed properly, the change can be challenged, and in some cases, the owner may still be held personally liable for past debts.

Done right, though, the conversion is smooth. The key is understanding what’s required and having someone experienced handle the details—from drafting the sale agreement to coordinating with the relevant authorities. With the right support, it’s a straightforward step that can open the door to a more secure and scalable setup.

How can Sovereign PPG help?

Whether you’re starting fresh or switching from a sole establishment to an LLC, Sovereign PPG can manage the process end to end. With deep knowledge of local requirements and strong ties to key authorities, we handle everything—from licensing and structuring to visas and ongoing PRO support.

Contact us for expert help with company setup, restructuring or local partner services across the UAE, Oman, Qatar or Saudi Arabia.

sovppg@sovereigngroup.com