Mauritius Residency Programme Update

Mauritius offers various residency programmes, including a 10-year Retired Non-Citizen Residence Permit and 20-year Permanent Residence Permits through property investment or business activity. Benefits include no inheritance tax, capital gains tax, or language requirements, and access to quality education and healthcare.

Continuing our series of less well-known countries that offer an excellent range of second or alternative residency programmes, this month we explore the options available in The Republic of Mauritius.

The Republic of Mauritius

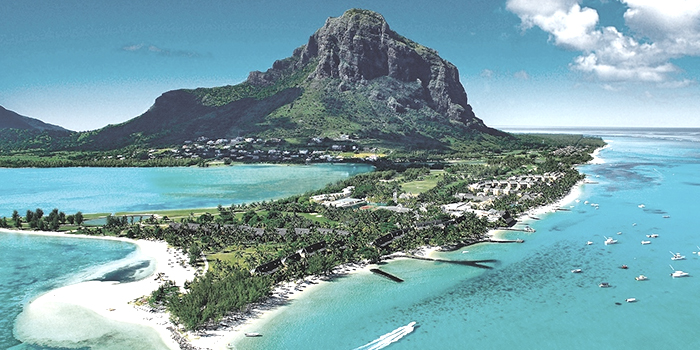

Often referred to as the ‘Jewel of the Indian Ocean’, the Republic of Mauritius is a small group of islands about 800 km east of Madagascar. Almost entirely surrounded by coral reefs and with a maritime subtropical climate, Mauritius has become a popular tourist destination and a highly sought-after location for foreign investors seeking a platform between Africa, Asia and the rest of the world.

Mauritius has a mixed developing economy based on manufacturing, agriculture, tourism, financial services, with ICT also growing in importance. Gross domestic product is now among the highest in Africa and Mauritius is ranked first in Africa and 13th worldwide in the 2020 World Bank Ease of Doing Business Report 2020.

Mauritius has attracted a wide range of settlers, who have brought their own cultural influences and have made Mauritius a vibrant and inclusive country. English and French are considered the official languages but Creole, a French-based patois, is the lingua franca. Mauritians are commonly multilingual.

Most of the population is concentrated on the main island of Mauritius, which hosts Port Louis, the capital and largest city. Mauritius has a good transport infrastructure. The road system is well developed and there are direct flights to Mauritius from 26 cities in 19 countries.

Offering political and social stability, a low-cost standard of living, a business-friendly environment and tax efficiency for both individuals and businesses, Mauritius is an ideal location for those looking to establish a new or alternative country of residency in which to live, work or retire.

Mauritius Residency Programmes

Mauritius offers residency programmes that cater for most personal requirements and budgets. Establishing residency in Mauritius enables foreign individuals and their qualifying dependants to enjoy a range of benefits, including:

- The right to live, work and/or retire in Mauritius.

- The option to include qualifying dependants including spouse, common law partner, fully dependent parents and unmarried children.

- A secure and safe environment in which to live.

- No language requirements.

- Access to quality educational institutions teaching in English and French.

- World-class medical facilities.

- A legal system combining common and civil law.

- Access to highly educated, skilled and multilingual workforce.

- No inheritance, estate or gift taxes

- Capital gains are generally not taxable.

Residency Permits

For high-net-worth individuals (HNWIs) or retired persons the most straightforward routes to obtain a Residency Permit in Mauritius are:

1. Retired Non-Citizen Residence Permit: 10-year Residency Permit

Open to applicants who are at least 50 years and can demonstrate they are able to transfer USD1,500 per month, or a total of USD 18,000 per annum, to a local bank account in Mauritius.

Holders are eligible to renew the permit upon expiry, subject to providing evidence that they have met the minimum income transfer requirements during each of the previous 10 years.

Retirees are also eligible to apply for a 20-year Permanent Residence Permit if they have either held residency for at least three years, or if they invest a minimum of USD200,000 in the acquisition of a property qualifying under the Property Development Scheme for Senior Living.

2. Property Development Scheme (PDS): 20-year Permanent Residence Permit (PRP)

Applicants are required to invest at least USD375,000 in one of the following real estate investment categories:

- Integrated Resort Scheme (IRS): qualifying projects larger than 10 hectares.

- Real Estate Scheme (RES): qualifying projects on freehold land not exceeding 10 hectares.

- Property Development Scheme (PDS): social and ecological impact-focused projects.

- Smart City Scheme (SCS): multipurpose eco-communities.

- Invest Hotel Scheme (IHS): new or existing hotel units in which investor can live for 45 days in any 12-month period.

- Ground + 2 Apartment Scheme (G+2): condominium developments at least two floors above ground.

The PRP is valid for 20 years and is renewable provided the investment is still held. Holders are permitted to work and invest in Mauritius without requiring an Occupation or Work Permit.

Please contact Sovereign for further information regarding properties to match your personal investment requirements.

3. Investment in a qualifying business activity: 20-year Permanent Residence Permit (PRP)

Applicants who invest at least USD375,000 in a qualifying business activity are eligible to be granted a 20-year PRP to ensure they have time to settle and make the business productive in the long term. Dependants, comprising the spouse, common law partner of the opposite sex, children and parents are also eligible for a PRP.

Qualifying business activities include agro-based industry, audio-visual, cinema and communication, banking, construction, education, environment-friendly and green energy products, financial services, fisheries and marine resources, Freeport, information technology, infrastructure, insurance, leisure, manufacturing, marina development, tourism and warehousing and initial public offerings (IPOs).

Occupation Permits

Mauritius offers three categories of Occupation Permit to individuals who do not have USD375,000 to invest. Occupation Permits apply for three to 10 years and, significantly, are also capable of being converted into a 20-year Permanent Residency Permit (PRP) after just three years if holders satisfy the relevant criteria.

Dependants of primary holders can apply for a residence permit for a duration not exceeding that of the holder but require an Occupation or Work Permit to work in Mauritius.

1. Investor: A shareholder and director in a company incorporated in Mauritius under the Companies Act 2001, an Investor is eligible to apply for an investor Occupation Permit under the following options:

- Standard (10-year residency permit) – For individuals who invest USD50,000 into a new Mauritius-based business.

- Net Asset Value (10-year residency permit) – For individuals who own or inherit an existing Mauritius business, with a net asset value of at least USD50,000 and a cumulative turnover of at least MUR12 million (c. USD260,000) during the three years preceding an application.

- High Tech Machine & Equipment – An initial investment of USD50,000, or its equivalent, comprising a minimum amount of USD25,000 transferred to the bank account of the applicant company and the equivalent of the remaining value in high tech machines and equipment.

- Innovative Start-Ups – An unspecified amount into an innovative project, with at least a 20% R&D component, that is approved by the Economic Development Board

Holders of an Occupation Permit as Investor are eligible to renew the permit after 10 years, provided the company has achieved a minimum annual gross income of at least MUR4 million annually as of the third year of registration.

Holders are also eligible to apply for a 20-year PRP after three years, provided the company has achieved either a minimum annual gross income of MUR15 million for the three years preceding the application, or an aggregate turnover of MUR45 million for any consecutive period of three years during the current permit.

2. Professional: Foreign professionals employed in Mauritius under a contract of employment and earning a minimum basic monthly salary of MUR60,000 (c. USD1,300), reduced to MUR30,000 for professionals in the information and communication technologies (ICT), business process outsourcing (BPO), pharmaceutical manufacturing and food processing sectors.

Holders are also eligible to apply for a 20-year PRP after three years, providing they have received a basic monthly salary of at least MUR150,000 for the preceding three consecutive years.

3. Self-Employed: A non-citizen engaged in a professional business activity on their own account who makes an initial transfer of USD35,000, or its equivalent, to a bank account in Mauritius and provides two letters of intent from potential local or international clients.

Holders of an Occupation Permit as Self-Employed are eligible to renew the permit after 10 years, subject to a minimum annual business income of MUR800,000 from the third year of registration.

Holders are also eligible to apply for a 20-year PRP after three years, providing they have achieved an annual business income of at least MUR3 million for the preceding three consecutive years.

Comprehensive Residency and Citizenship Planning Services

Sovereign works closely with applicants during each stage of the planning and implementation process. When combined and managed correctly, the following Sovereign Group services will enable individuals and families to develop and implement a comprehensive, flexible and tax efficient strategy:

- International residency and citizenship programmes

- Tax residency

- Trusts and foundations

- Estate and succession planning

- International retirement plans

- Wealth management

- Corporate structures and banking

- International life and medical insurances

Contact us to learn more

For further information, to discuss your requirements and/or to determine whether you qualify for the one of the Mauritius or any other residency or citizenship programmes, please contact Sovereign’s Residency and Citizenship Planning team at: RCBI@sovereigngroup.com