The benefits of ‘loop structuring’ for South African residents: four years on

What is a Loop Structure?

A loop structure is broadly any arrangement through which a South African resident holds an interest in an overseas (offshore) vehicle which, in turn, invests in South African assets, typically South African companies. Previously such structures were only permitted in very limited circumstances, such as where a South African resident did not hold more than 40% of the shares in a foreign company that held interests in South Africa.

Regulatory Framework

On 4 January 2021, the South African Reserve Bank (SARB) issued exchange Control Circular No. 1/2021, which served to lift the restriction on ‘loop structures’ in respect of individuals, companies and private equity funds that are tax resident in South Africa. The reform, which was effective as of 1 January 2021, was designed to encourage inward investments into South Africa.

Estate Planning Opportunities Outside South Africa

The legalisation of loop structures has created interesting estate planning opportunities outside South Africa.

Many South Africans who previously took money overseas via various offshore allowances were obliged to establish offshore structures to hold their offshore assets, in addition to their onshore structures in South Africa, held their South African assets. This often meant having mirror structures that were costly to set up and maintain, and also doubled the administrative and compliance burden.

The removal of the prohibition on loop structures meant that South Africans have been able, since 2021, to set up an offshore trust and company structure as their primary estate planning vehicle which can also then hold their assets in South Africa.

Tax Efficient Additional Outflow Streams

As a result of the reforms, a South African company can now legally move income streams abroad in the forms of dividends, without necessarily moving such funds directly to the shareholders who would then be obliged to utilise their personal investment allowances which are limited to ZAR11 million per year.

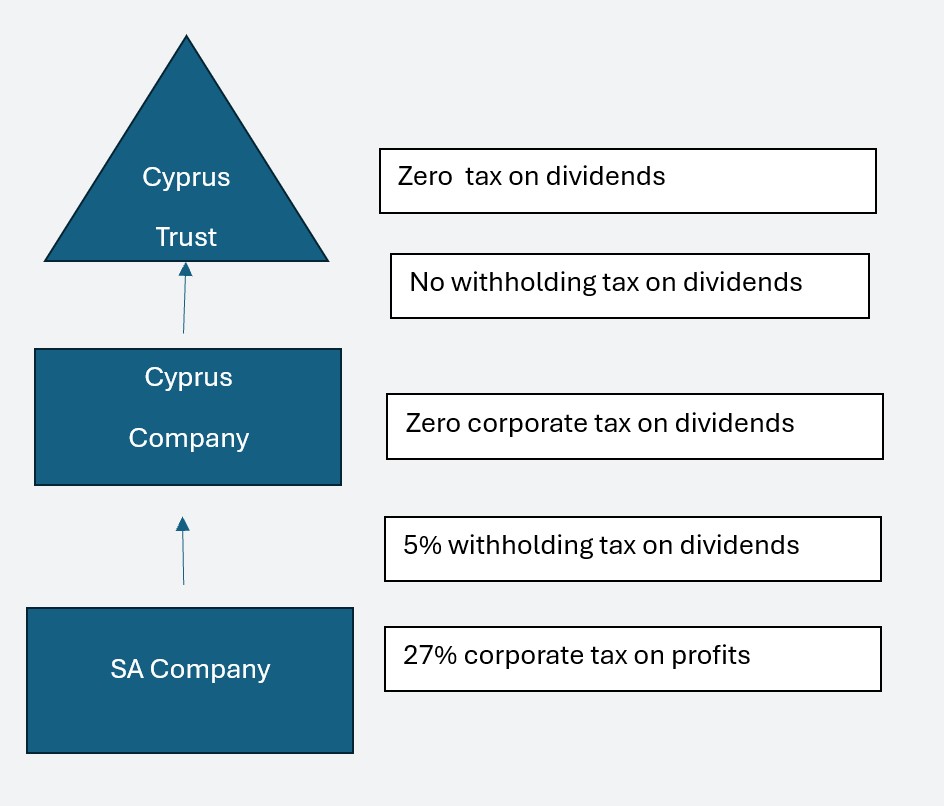

If a loop structure is implemented correctly, such funds can now be extracted as a dividend and paid to an offshore company and/or trust. This not only means that the creation of loans between the SA tax resident individual and the company/trust can be avoided, but also offers the potential for a reduction in dividend withholding tax provided that the offshore structure is genuinely based in a jurisdiction that has a suitable double tax agreement (DTA) with South Africa. These jurisdictions include Cyprus, the UK, Mauritius and Singapore.

Historically, South Africans have paid dividends withholding tax at a rate of 20% on profits distributed from South African companies. If, however, such dividends are paid to a company that is tax resident in one of the above mentioned jurisdictions, the withholding tax can be reduced to just 5%.

Reporting Requirements

A loop structure must be reported to an Authorised Dealer by the relevant South African tax resident. If, for example, a Cyprus company acquires the shares of a South African company that banks with Capitec Bank, a notification letter and supporting documentation would need to be submitted to the Exchange Control Department of Capitec Bank.

The Exchange Control Department will inform the South African tax resident that the share certificate must be endorsed ‘non-resident’ within 30 days. The original share certificate issued to the Cypriot company will then need to be taken to the Bank’s nominated branch to be endorsed as ‘non-resident’.

Failure to have the shares endorsed is a breach of the regulations and may be subject to penalties. Without the endorsement, the South African company cannot distribute any dividends to a non-resident shareholder. It will also affect the ability of a local purchaser to pay for the shares held by a non-resident shareholder in a South African company.

SARB approval in respect of an endorsement is only required in cases where it is has been more than 12 months since the acquisition of the relevant shares.

The Authorised Dealer must also view an independent auditor’s report verifying that the transaction has been concluded on an arm’s-length basis and at a fair market-related price.

When the transaction is complete, the Authorised Dealer must submit a report to the SARB’s Financial Surveillance Department (FinSurv). This report must include the name(s) of the South African affiliated foreign investor(s), a description of the assets acquired, the name of the South African target investment company, the date of the acquisition, and the foreign currency amount introduced.

The Authorised Dealer must also submit an annual progress report to FinSurv which will be requested from the representatives of the South African company.

Sovereign Structuring Services

If you are considering investing into an offshore entity with a loop structure component, Sovereign Trust (SA) can assist in setting up and administering the structure and ensuring that it is established in the most tax efficient manner.

It should be noted that using authorised foreign assets via a loop structure to reinvest back into South Africa may diminish diversification in respect of currency, geographical and market concentration risks. As such, it is strongly recommended to first seek financial advice and review your personal circumstances and overall investment plan.

Organogram