Asia Focus – August 2017

- Opening a business bank account in Hong Kong – maximising your chances of success.

- What is my best option for opening a bank account in Hong Kong?

- Singapore is best city to work in a start-up

- Hong Kong top Asian city for ultra high net worth individuals

Welcome to the Sovereign Asia Focus newsletter, which will complement our existing China Focus newsletter and will, we hope, help to keep Sovereign clients up-to-date with news and views from around this burgeoning region – Hong Kong and Singapore, in particular, where we have long-established offices.

Opening a business bank account in Hong Kong – maximising your chances of success.

The difficulty of opening business bank accounts in Hong Kong has been well documented in recent years. It is still very challenging. Despite media attention, pressure from the Hong Kong Monetary Authority, InvestHK, the Chambers of Commerce and industry groups in Hong Kong, start-ups and SMEs in particular are still having great difficulty in opening bank accounts.

Why is it difficult to open a bank account in Hong Kong?

- Regulatory pressure – Hong Kong banks have been having to update their internal processes to deal with regulatory changes on an almost continual basis. No sooner had they addressed the US Foreign Account Tax Compliance Act (FATCA), than along came the OECD’s Common Reporting Standard (CRS), the G20 High-Level Principles on Beneficial Ownership Transparency and now they are also having to deal with the OECD’s Base Erosion and Profit Shifting (BEPS) initiative.

- Geopolitical uncertainty and evolving criminal methodologies – financial institutions have found managing evolving sanctions policies to be a significant challenge, while evolving criminal methodologies are also seen as the biggest future threat. This has been making them understandably concerned about the need to manage and update risk policies, process and controls… and all while they’re still dealing with the fallout from the 2008 global financial crisis.

- Compliance – to deal with the issues outlined above, banks have invested heavily in their compliance teams. These teams are now more influential than ever in the client ‘onboarding’ process. If you look like a potential risk, the banks won’t do business with you unless the probable benefits outweigh the compliance costs. In this environment there is very little upside for a bank to do business with a start-up.

- Mismanagement – regardless of how difficult the business environment is, or has been, the banks have not helped themselves. Banks globally have paid $321 billion in fines since 2008 for an abundance of regulatory failings from money laundering to market manipulation and terrorist financing, according to data from Boston Consulting Group. All this means that banks have even less appetite for business risk.

What do Hong Kong banks like?

- Hong Kong-based trading companies – Hong Kong banks are more likely to open an account for you if you have, or are planning to have, an office in Hong Kong, employ staff in Hong Kong, have customers and/or suppliers in Hong Kong etc. In other words they are looking to see real substance in Hong Kong. This rule of thumb applies to new businesses being set up in Hong Kong, as well as to subsidiaries of international companies being established here.

What do Hong Kong banks dislike?

- Offshore companies – if your company has been incorporated in a jurisdiction outside of Hong Kong, and unless you have registered as a branch or representative office, it is almost impossible to open an account at a Hong Kong bank at present.

- Complicated ownership structures – the more shareholders you have, and the more layers of entities (trusts, holding companies etc.) that are involved, the more difficult it will be to pass compliance checks.

- Holding companies – companies that receive most of their income from passive sources (investments) trigger a higher level of scrutiny for the banks under CRS and FATCA, and are therefore viewed as higher risk than active trading companies.

- Hong Kong companies whose officers and signatories reside outside of Hong Kong – unless your business has a clear reason to have a bank account in Hong Kong, it will be more difficult to get an account opened.

- Ecommerce – getting a merchant account set up with a Hong Kong bank is far more difficult that it should be. Hong Kong banks don’t like connecting to payment gateways because they cannot always identify the geographic source of the funds hitting your account.

- Cash based businesses – Hong Kong banks like to know where the funds being remitted to your account come from. Cash is a major problem for banks from a compliance point of view. The same is true for the new digital currencies.

- Certain industries and jurisdictions – I won’t go into huge amounts of detail here, but be aware that Hong Kong banks, as elsewhere, have lists of industries, countries and passports that they don’t like. Do your research to avoid wasting your time.

- Regulated businesses – Hong Kong banks don’t like dealing with companies that are heavily regulated. If your business needs a licence to operate, then the bank will generally want to see authorisation in place before they will consider opening an account for you.

- Start-ups – Hong Kong banks are generally not going to sell many additional products to start-ups and will therefore not make much (or even any) money from them. Simply put, the risk-reward equation does not work for the banks. The one thing the banks need to justify taking on the risk is ‘business proof’.

What is ‘Business Proof’ and how can I get some?

Business proof is what banks need to help them predict the future activity of an account so they can give you a risk score and monitor account activity on an ongoing basis. Existing businesses have a natural advantage here but the banks expect you to be able to provide some or all of the following information:

- Business plan – all business plans are different but the most important consideration is to adapt your plan to suit your audience. Banks won’t necessarily read a 20-page document or go through a complicated PowerPoint demonstration. They simply need to understand how you will make your money and why you need a bank account in Hong Kong. Provide sufficient information to enable a bank to understand your business and remember that you are not speaking to an expert in your area of business. So keep it simple. The bank will ask you to provide more information if it needs it.

- Account activity – be prepared to answer the following questions, which can also be incorporated into the business plan.

- Expected annual turnover?

- How many monthly inward remittances do you expect? What will the average amount be?

- How many monthly outward remittances do you expect? What will the average amount be?

- What currencies will you need?

- How will you make / receive payments (cheque, cash, TT, etc.)?

- In which countries are your customers / suppliers located?

- Supporting documentation – anything and everything helps here. Mobile phone contracts, consultancy agreements, employment agreements, introducer agreements, invoice templates, insurance policies, supplier invoices, rental agreements (see below) etc. If you don’t have any contracts in place, try to get letters of intent with potential customers. Basically, the bank wants to see some documentary proof to support your business plan. The bank will also want to do due diligence on your counterparties, so provide it with websites and contact details where practical.

- Rental agreement – this is possibly the single most important supporting document. Some banks prefer a stamped lease, some will accept a virtual office agreement but you need to tick this box. Ideally, your commercial address should not be the same as that of your company secretary or accountant.

- Marketing Collateral – if you don’t have any, get some. If you don’t have a full website, at least put a landing page in place. If you don’t have a logo, get one immediately; you can always change it later. Get some business cards and create some templates for the documents your business will need. Banks will need to be able to visualise your business. Help them to do so.

What is my best option for opening a bank account in Hong Kong?

- Talk to a professional services provider – You may only get one chance to open a bank account in Hong Kong. As a professional services provider in Hong Kong, Sovereign has long standing relationships with a broad range of Hong Kong banks. We know the policies and criteria of different banks and can help to determine which one will be the best fit for you. We can then guide and assist you with preparing your application and supporting documentation to maximise your chances of success, before effecting an introduction to your chosen bank.

- Open an offshore account – there are a number of international banks that will open accounts for Hong Kong and offshore companies. Such banks generally only work with qualified introducers, such as Sovereign. When you have generated at least six months of account activity with an offshore bank, a bank in Hong Kong is more likely to accept your application because they can more accurately assess risk by analysing your account history. You will also have more supporting documentation in place after six months of trading.

Singapore is best city to work in a start-up

Singapore has been named the best city for those looking for work in start-ups, thanks to its high-quality healthcare, safety and vibrant start-up ecosystem.

The index was released by Nestpick, a Berlin-based aggregator website for furnished apartments optimised specifically for expats and international students. It ranked 85 cities around the globe according to five different criteria – start-up ecosystem, salary, social security and benefits, cost of living and quality of life.

Surprisingly the Lion City outranked San Francisco, despite Silicon Valley’s reputation as the start-up capital of the world. San Francisco scored highest on the start-up ecosystem and salary metrics, for both entry level and experienced positions, but it ranked in the bottom 10 cities for cost of living and quality of life.

Those who have been following Singapore’s rise as a start-up and innovation hub may be less surprised by the results. It boasts a young but experienced cohort of software engineers. It is also advantageously positioned as one of the wealthiest communities in the world.

Thanks to its advanced infrastructure, highly educated workforce and proximity to a number of emerging and developed markets, Singapore has become a natural hub for tech companies and investors.

The Finnish capital Helsinki was second, scoring the highest for equality and with a good score for quality of life and social security. San Francisco, Berlin and Stockholm were also included in the top five cities to work for start-ups. These were followed by Tel Aviv, Zurich, Seoul, Hamburg and Toronto.

Seoul was the only other Asian city to land in the top ten. Hong Kong, Beijing and Tokyo appeared further down the list. Several other Southeast Asian cities, including Bangkok, Hanoi, Kuala Lumpur and Jakarta also made the rankings, but were ranked at 70 or below.

Ömer Kücükdere, managing director of Nestpick, said, “Certain cities may offer bigger paychecks, but after considering taxes and living expenses, the return may not be so high. Similarly, professionals should consider quality of life: will vacation days be adequate to visit home? Is healthcare as accessible as you would like it to be? We believe that time taken researching potential employers should not overshadow understanding the best cities in which to work.”

Last year Singapore launched the Startup SG Accelerator, which supports incubators and accelerators in strategic growth sectors that take on the role of catalysing growth opportunities for high potential startups through their programmes, mentorship and provision of resources. Startup SG Accelerator provides funding and non-financial support for these partners to further enhance their programmes and expertise in nurturing successful startups.

Hong Kong top Asian city for ultra high net worth individuals

In 2016, the world’s ultra high net worth (UHNW) population – individuals with $30m or more in net worth – grew by 3.5% to 226,450 individuals, a partial recovery from a sharp fall a year earlier. Their combined wealth also increased in 2016, expanding by 1.5% to $27 trillion. The average net worth of the ultra wealthy declined for the first time since 2013, according to the Wealth-X 2017 ultra wealth report.

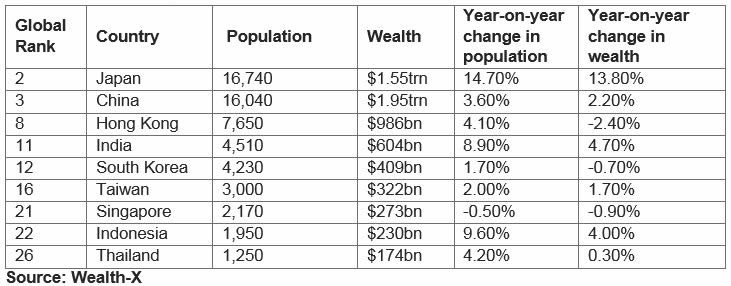

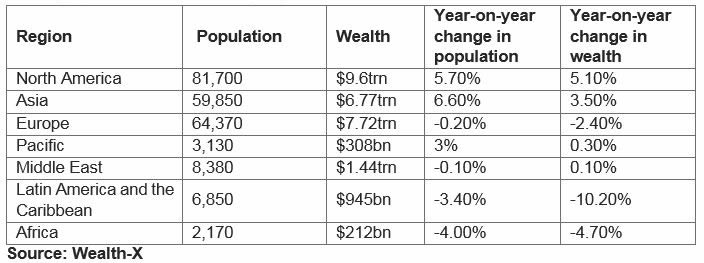

There were sharp regional fluctuations in dollar-denominated wealth creation, with North America (+5.1%) and Asia (+3.5%) recording the only significant rises in wealth in 2016. The picture was subdued in Europe, with the ultra wealthy population and its total wealth edging slightly lower, while fortunes remained largely unchanged in the Middle East. Latin America and the Caribbean registered a significant fall and Africa also posted a decline.

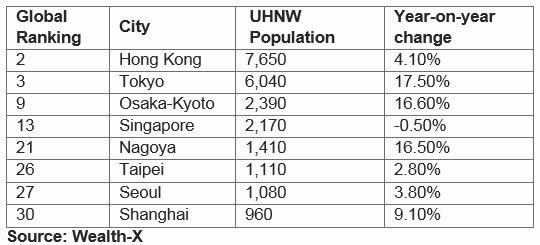

The New York metropolitan area bolstered its position as the world’s largest UHNW city. Hong Kong has the most number of UHNW individuals in Asia and globally it ranks second, ahead of Tokyo. London remains the largest UHNW city in Europe, but its lead over Paris narrowed sharply. Though China has the world’s third-largest ultra wealthy population, Shanghai came in joint 29th, emphasising the point that robust wealth creation is occurring not just within its top-tier cities.

North America recorded the strongest growth in ultra wealth in 2016, posting a 5.1% increase and consolidating its position as the world’s dominant UHNW region with a 35.6% share of global wealth. The rise in net worth was accompanied by a robust expansion of the region’s ultra wealthy population, which advanced by 5.7% to a record high of 81,700 individuals.

Asia was the only other region to register a significant increase in UHNW wealth, which rose by 3.5% on the back of solid gains in Japan and India and a more moderate gain in China. The region recorded the fastest growth in its ultra wealthy population, with a 6.6% expansion. Asia’s market share of the global ultra wealthy population has been increasing steadily and accounted for over 26% in 2016, up from just above 18% a decade earlier. Resilient economic growth and supportive currency movements were the main drivers of wealth gains across the region in 2016.

UHNW population and wealth by region

Investor fears of a major slowdown in China were largely unfounded, while ongoing reforms in India continued to support robust economic activity, despite the disruption of a banknote demonetisation in November. Japan recorded the largest rise in UHNW wealth of all the Asian countries, boosted by the strength of the safe-haven Japanese yen, which even appreciated against the dollar. There was a positive overall equity performance in the region (in dollar terms) but this disguised quite sharp local-currency falls in China’s benchmark Shanghai Stock Exchange and Japan’s Nikkei Index.

Much of the expansion of the global ultra wealthy population will be driven by Asia, notably China and increasingly India – the latter is likely to emerge as the region’s fastest-growing large economy. The number of ultra wealthy individuals is also expected to expand rapidly in other high-growth Asian countries, such as Vietnam and Indonesia.

Although the pace of headline economic growth in China is expected to moderate, discretionary income levels across the country will continue to rise, reshaping the world’s largest consumer market and creating additional opportunities for wealth creation, especially in retail and real estate. China’s One Belt, One Road (OBOR) initiative will also present numerous openings for new and expanding fortunes across Asia and its surrounding regions, particularly in the areas of infrastructure, energy and technology.

The leading five countries (the US, China, Japan, Germany and the UK) accounted for almost 57% of the global ultra wealthy population and just short of 55% of UHNW wealth in 2016. Overall, the top 30 countries accounted for around 93% of both the world’s ultra wealthy population as well as its total wealth. Of these 30 countries, 12 are in Europe, nine are in Asia, four are in the Middle East, two are in North America and two in Latin America, and one is in the Pacific region.

‘Emerging Asia’ (Asia excluding Japan, Singapore and Hong Kong) represents an increasingly important and growing cohort of ultra wealthy individuals. In 2016, the region accounted for almost 15% of the global ultra wealthy population, up from 10.5% in 2010. Growth has been driven predominantly by China on the back of still impressive rates of economic growth and the rapid evolution of the technology, consumer retail and real estate sectors. More recently, however, there has also been strong growth in the ultra wealthy populations of India and Indonesia and, from a lower base, those of Vietnam and the Philippines.

On average, ultra wealthy individuals in emerging Asia are slightly older than their global peers and have a higher level of wealth. Most are still at the wealth creation rather than the wealth preservation stage, which contrasts with the multigenerational wealth patterns more common in Europe and North America. That said, the share of inherited wealth is expected to rise further over the next decade as the emerging Asia region undergoes its first major intergenerational wealth transfer.